Tariffs Spark Volatility and Opportunity: Cliff’s Notes

U.S. Announces New Reciprocal Tariffs: What Investors Need to Know

The so-called Liberation Day arrived with a bang as the Trump administration announced the long-awaited reciprocal tariff rates on our global trading partners. The reaction in markets has been fierce as the view from Wall Street is that the announced rates were worse than most expected. Early estimates are for $530 billion of tariffs, equivalent to 1.8% of U.S. GDP, 8.4% on consumer goods spending, and a weighted average tariff rate of about 18% on total imports. If these numbers remain in place, it would be the highest U.S. tariff rate since Smoot-Hawley in the 1930s. The tariff/tax tradeoff is intended to shift the tax burden from income to consumption and to be used as a source of funds to reduce our massive fiscal deficit which currently stands at roughly 7% of GDP.

Breaking Down the New U.S. Tariff Policy

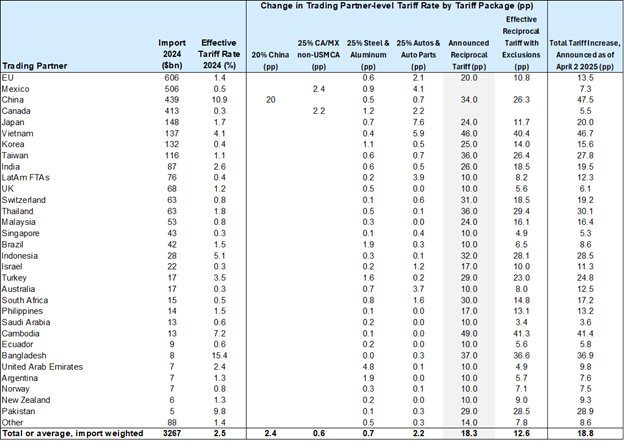

President Trump announced a "reciprocal" tariff plan that consists of two parts. First, a 10% baseline tariff would apply to imports from all countries excluding Canada and Mexico. This tariff is set to take effect April 5. Second, most major trading partners excluding Canada and Mexico would face an additional tariff that equals half the ratio of the US bilateral trade deficit with the country divided by US imports from that country. This second component would take effect April 9. Here are the resulting rates on a country-by-country basis with our largest trading partners courtesy of Goldman Sachs:

Source: Goldman Sachs

The fact that these two components were structured separately suggests that the 10% baseline tariff is unlikely to be negotiated down, but that the additional tariff rate could decline following negotiation with trading partners.

Export-driven Asia, led by China fares the worst, while our neighbors Canada and Mexico get more favorable treatment. When combined with the previously announced tariffs, the effective tariff rate on China now stands at nearly 50%. (It’s probably not a bad time to go buy that new iPhone or flat-screen TV!!!)

While the ultimate impact to the economy is still highly uncertain, much will depend on how other countries react, but what is clear is that the tariffs will be net negative for GDP growth and potentially inflationary in the short-term. The one-time step up in goods pricing effectively serves as a tax, and will likely weigh on consumption. It’s important to keep in mind that tariffs, immigration and DOGE, the early priorities for the administration, while contractionary for growth in and of themselves, are only half the story. The market will now turn its attention to tax cuts, via budget reconciliation, and deregulation which are both stimulative for the economy. How these crosscurrents ultimately play out, will go a long way in determining the path of the economy and markets over the coming years. We think policy uncertainty will ease. Yet prolonged uncertainty increases the risk that weakening sentiment leads to less spending, lower earnings and job loss.

Initial Market Reaction to U.S. Tariffs

The initial reaction in markets has been to “sell first and ask questions later.” At the time of this writing the S&P 500 was down nearly 4% the day after the announcement, pushing into a technical correction down 10% from the highs. The tech-heavy Nasdaq, which has been the source of leadership over the past two years, has been hit harder, falling nearly 20% from the all-time high. While markets will likely remain volatile as uncertainty remains high, there’s no question that there will be opportunities to buy high quality assets at great prices over coming weeks and months. This will be an intense area of focus on the investment team at Cornerstone -- we’re already hard at work looking for value!

It is during times like these where we are reminded of the benefits of diversification, and the need for owning multi-asset portfolios. While stocks are under pressure, bonds are shining – up approximately 3% year-to-date and resuming their role as portfolio ballast. Alternative investments, a major focus of Cornerstone over the past few years, likewise are performing nicely during the equity selloff.

The important thing to remember is that pullbacks and corrections, while painful in real-time, are a normal part of the ebbs and flows for long-term investors. According to J.P. Morgan, over the past 45 years, the S&P 500 experienced at least one decline of 14.1% on average each year. Yet despite these intra-year declines annual returns were positive in 34 of 45 years.

Staying Focused on Long-Term Investment Strategy

It’s during these times when emotions can run high, but we as investors can’t allow our emotions to derail our investment plans. As always, the team at Cornerstone is here for you to answer your questions, talk through our investment strategy, and to ensure that your portfolio is aligned with your long-term objectives. Don’t hesitate to reach out if we can be of service! Thank you for being a loyal client and for taking the time to read my note.

Sincerely,

Chief Investment Officer

This material provided by Cornerstone Wealth Group is for informational purposes only. It is not intended to serve as personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment. Any securities mentioned herein are not to be taken as advice or recommendation to buy or sell a specific security. The information provided may not be applicable to your account managed by Cornerstone Wealth Group. Please contact Cornerstone Wealth Group for specific information regarding the holdings and trading activity of your account. Opinions expressed in this commentary do not represent a personalized recommendation of a particular investment strategy to you. Additionally, you should review and consider any recent market news. All expressions of opinion are subject to change without notice in reaction to shifting market or other conditions. Data provided is believed to be accurate, but its accuracy, completeness or reliability cannot be guaranteed.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

The Nasdaq Composite Index is a market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq listed on the Nasdaq stock exchange. It is a broad index that is heavily weighted toward the important technology sector. The index is composed of both domestic and international companies.

Investment advisory services offered through Cornerstone Wealth Group, LLC dba Cornerstone Wealth, an SEC registered investment adviser. Custody and other brokerage services provided to clients of Cornerstone Wealth Group, LLC dba Cornerstone Wealth are offered by Fidelity Brokerage Services LLC, Member NYSE/SIPC and Charles Schwab & Co., Inc., Member FINRA/SIPC.