Required Minimum Distributions: The Overlooked Retirement Rule That Impacts High-Earners Most

The Hidden Impact of RMDs on High-Earners

Why Pre-Retirees Can’t Ignore RMDs

You’ve been diligent. Savvy, even. Through every promotion, big deal, and bonus check, you tucked money away into your retirement savings for the day you’d finally step off the treadmill and trade deadlines for real downtime. But there’s a little-known IRS rule—a “gotcha” buried deep in the fine print—that could upend your plans if you overlook it: Required Minimum Distributions, or RMDs.

For high-income earners, RMDs are often the silent saboteur, the rule that quietly turns your savings into a tax headache, chips away at your legacy, and injects uncertainty right when life should feel most secure.

It’s a twist that’s caught even the most financially savvy off guard.

Why the Right Retirement Plan Advisor Matters

Fortunately, a financial planner can ensure you don’t have to let a government formula dictate your financial future.

The right retirement plan consultant can help you see around corners, bringing creative, tax-smart strategies to the table and keeping your plans focused on family, not just the IRS. In this guide, we’ll unpack why RMDs deserve your attention and give you a roadmap for keeping more of what you’ve built, on your terms.

RMDs Explained: The Rule You Can't Afford to Overlook

What Are Required Minimum Distributions (RMDs)?

Required Minimum Distributions (RMDs) are IRS-mandated withdrawals from tax-advantaged accounts such as traditional IRAs, 401(k) plans, and 403(b) plans. Once you reach a certain age, known as the required minimum distribution age, you’re obligated to take out a minimum amount each year, based on your account balance and the IRS’s actuarial tables.

For high earners, the balances in retirement accounts are often substantial, meaning RMDs can be sizable and the tax consequences considerable.

401 (k) Required Minimum Distribution: The Technical Details

The 401(k) required minimum distribution rules mirror those of IRAs, but they also have their own nuances.

Failing to withdraw the correct amount on time can result in steep IRS penalties, up to 25% of the amount not withdrawn, though that penalty drops to 10% if corrected promptly.

The required minimum distribution age as of 2025 is generally 73, thanks to the SECURE Act 2.; However, those born later will need to follow new timelines. If you’re still working at 73 and don’t own more than 5% of the business sponsoring the plan, you might be able to delay RMDs from your current employer’s 401(k).

Required Minimum Distribution Table 2025

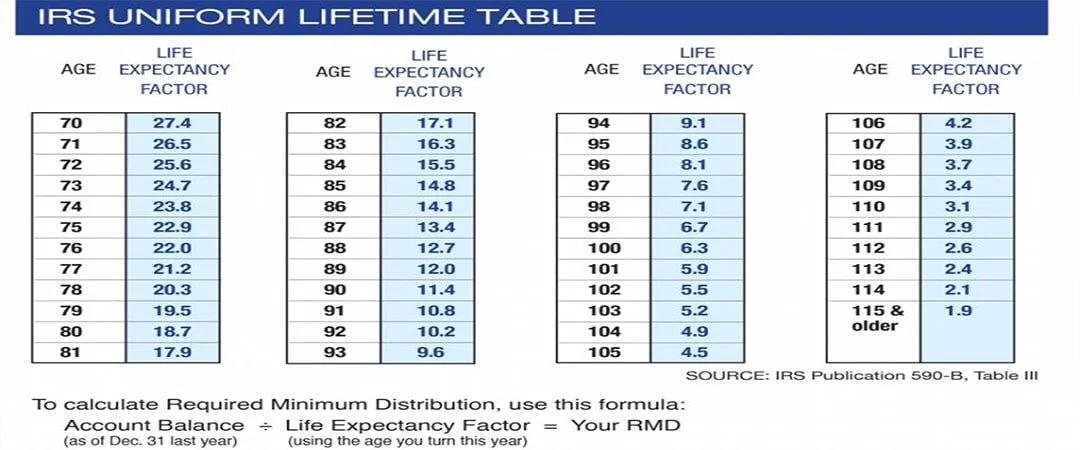

RMD amounts are determined using the IRS’s uniform lifetime table, which is updated annually, but Roth IRAs do not require RMDs, offering a more tax-friendly option for some retirees.

The required minimum distribution table 2025 lists the factors you’ll use to calculate your withdrawal. For example, if you’re 75, you find your distribution period in the table, divide your year-end account balance by that number, and that becomes your RMD for the year.

How to Calculate Your 2025 RMD

Find your age on the required minimum distribution table 2025.

Divide your December 31st IRA or 401(k) balance by the corresponding factor.

The result is the minimum you must withdraw to avoid penalties.

Is it better to take your RMD monthly or annually?

The IRS only requires that you withdraw your total RMD amount by year-end, so you have flexibility. Taking RMDs monthly can help with budgeting and may smooth out market fluctuations, while annual withdrawals allow your investments to grow tax-deferred for longer.

The best approach depends on your cash flow needs, investment strategy, and tax planning goals. A retirement plan consultant can help you decide which method aligns with your overall financial plan.

Why RMDs Are a Bigger Problem for High-Earners

Larger tax-deferred account balances mean larger mandatory withdrawals, which can push you into a higher tax bracket, trigger Medicare surcharges (IRMAA), or disrupt carefully planned retirement income streams.

A retirement planning specialist can help you time withdrawals, review account types, and design strategies that minimize tax surprises and preserve your financial goals.

RMD Pitfalls: The Stealth Tax Bomb

It’s easy to think of retirement savings as finally having the freedom to write your own story.

But for high earners, Required Minimum Distributions can make that plot a lot more complicated than you’d hoped. Just as you’re about to enjoy your savings, the IRS shows up with a new script, and it doesn’t come with a happy ending unless you plan.

The “Surprise” Tax Hit for High Earners

Here’s the worst-kept secret: large accounts mean large mandatory withdrawals.

Suddenly, the money you had planned to spread over decades has to be taken at once, landing you in higher tax brackets, triggering IRMAA surcharges, and increasing the taxes on your Social Security.

These “stealth taxes” are more than just speed bumps; they can shrink your lifestyle and upend your legacy plans.

Overlooking RMDs? The Cost Is Real

Ignoring RMD rules isn’t just a matter of missing paperwork; it’s an expensive mistake.

Getting caught flat-footed can cost you tens of thousands, even hundreds of thousands, in taxes and penalties. The consequences reach beyond this year’s tax bill; they impact future compound growth, your ability to leave gifts, and even your peace of mind.

Don’t Go It Alone. Work With a Retirement Plan Consultant

If you want to keep your financial story on your terms, it pays to bring in an expert. An experienced retirement plan consultant or retirement planning specialist can uncover tax traps, optimize your withdrawals, and help you sidestep common high-earner pitfalls.

With professional guidance, you turn the IRS’s “script” into a plan that supports your vision for retirement, and beyond.

5 Powerful RMD Strategies for High-Earners

Outsmarting the RMD Tax Trap

If RMDs sound like a tax trap, the good news is that there are proven ways to defuse it, especially when you plan. Here are five strategies top retirement plan consultants use to help high-income earners keep more of what they’ve built.

1. Start Roth Conversions Early

Don’t wait for RMDs to take you by surprise.

By converting portions of traditional IRA or 401(k) balances to Roth IRAs in the years leading up to retirement, you reduce future mandatory withdrawals and can enjoy tax-free growth. Retirement planning specialists can help you time these conversions for maximum tax efficiency.

2. Make Strategic Pre-RMD Withdrawals

Sometimes it pays to take out money before you have to.

If you retire early or have a lower-income year, consider withdrawing from your tax-deferred accounts ahead of the required minimum distribution age. A retirement plan advisor can help you use these windows to manage your future tax bracket.

3. Maximize QLACs for Deferral

Qualified Longevity Annuity Contracts (QLACs) let you defer up to $200,000 from RMD calculations until as late as age 85.

For healthy, affluent retirees, this can mean less taxable income now, more later, and added longevity protection. Retirement plan advisors can determine if a QLAC blends well with your strategy.

4. Charitable Giving: QCDs & Trusts

If philanthropy is part of your plan, Qualified Charitable Distributions (QCDs) allow IRA owners over age 70½ to direct up to $100,000 per year tax-free to qualified charities, fulfilling RMDs without increasing taxable income.

Charitable trusts can also play a role in advanced tax planning in retirement.

5. Beneficiary and Legacy Planning Under New Rules

With recent changes, most non-spouse heirs must deplete inherited IRAs within 10 years—the “stretch” IRA benefit is no longer available for most. Thoughtful, early planning with your retirement plan consultant can help minimize legacy tax impacts and smooth the transfer of multi-generational wealth.

When Professional Advice Makes the Difference

While these tools can be powerful, the key is to customize a solution to your specific goals, income, and legacy needs. A specialized retirement plan consultant or retirement planning specialist makes sure your RMD strategy fits your life—not the other way around.

Case Study: The Cost of Overlooking RMDs

How One High Earner Saved Six Figures With the Right Retirement Plan Consultant

Meet Steve, a successful executive who spent decades methodically funding his 401(k) and IRA.

Like most high earners, Steve assumed he’d earned the luxury of a flexible retirement. But when he turned 73 and saw his first required minimum distribution table for 2025, he realized that those “minimum” withdrawals would catapult him into a higher tax bracket, creating new Medicare surcharges and pushing a significant portion of his Social Security into the taxable column.

Steve’s initial reaction? Frustration.

However, a retirement plan consultant showed him how starting Roth conversions in his early sixties and taking strategic withdrawals before his RMD start date could have left him with a smaller RMD, a more stable tax bill, and a significantly larger legacy for his children. Acting even a few years earlier could have saved him and his heirs over $160,000 in unnecessary taxes.

The difference?

Strategic tax planning in retirement, with expert guidance.

Get Fiduciary Guidance, Don’t Go It Alone

Why Specialized Advice Makes a Difference

Navigating RMDs, tax planning in retirement, and new legislation is not a do-it-yourself project, especially for high earners.

Even the most experienced investors can miss critical details that affect taxes, Medicare, and inheritance, leading to unforeseen tax implications. That’s where a retirement plan consultant or retirement planning specialist comes in.

Working With Retirement Planning Specialists Matters

A skilled retirement plan advisor helps you meet the IRS’s requirements and works to keep your bigger picture in sight: maintaining lifestyle, safeguarding your legacy, and managing your total tax burden.

With new RMD rules arriving every year, tailored advice is essential for achieving peace of mind and a future you control.

Next Steps and Call to Action

Protect Your Wealth and Legacy From RMD Surprises

You don’t have to let RMDs dictate the next chapter of your retirement.

You can download our Roadmap to Retirement Guide here! Or read our blog, Top 10 Retirement Planning Questions Answered.

If you’re seeking specific guidance, consider scheduling a call with a seasoned retirement plan consultant. Cornerstone’s retirement planning specialists will help you optimize tax planning in retirement, make sense of the required minimum distribution table for 2025, and keep your dreams on track.

This is for informational purposes only and does not serve as personal advice. Please speak to a qualified representative regarding your unique circumstances. Links within this blog are not associated to Cornerstone Wealth and are subject to change. Hyperlinks will take you to a third-party website whose content Cornerstone Wealth does not control. Investment advisory services offered through Cornerstone Wealth Group, LLC dba Cornerstone Wealth, an SEC registered investment adviser.