How Much Do You Know About the 2025 Tax Sunset?

What is the 2025 Tax Sunset?

The 2025 tax sunset is a critical event set to occur at the end of 2025 when key provisions of the Tax Cuts and Jobs Act (TCJA) are scheduled to expire. Understanding the implications of this tax reform sunset is vital for individuals, families, and businesses. The sunset will herald substantial changes to tax laws, potentially impacting tax efficiencies, deductions, exemptions, and the overall landscape of tax planning services.

Overview of the Tax Cuts and Jobs Act (TCJA)

The Tax Cuts and Jobs Act, enacted in 2017 by Congress, brought sweeping changes to the United States tax code through significant legislation. Among its many provisions were reduced tax rates for individuals and corporations, a higher standard deduction, and the elimination of personal exemptions. The TCJA aimed to spur economic growth by providing tax relief and encouraging investments. However, many of its benefits are temporary and set to expire at the end of 2025.

Key Provisions Set to Expire

Several key provisions of the TCJA are slated to sunset at the end of 2025. These include reducing individual income tax rates, the increased standard deduction, the enhanced child tax credit, and the cap on state and local tax (SALT) deductions. Numerous business tax breaks, such as the pass-through business income deduction, will also expire. These expirations will require significant adjustments for taxpayers and necessitate proactive tax planning.

Why Should You Care About the TCJA Sunset?

The upcoming TCJA sunset will bring about dramatic changes that affect tax efficiencies, estate and gift tax exemption, itemized deductions, and complex tax laws. It’s important to be aware of these changes to prepare adequately.

Impacts on Tax-Efficiencies

Tax efficiencies refer to measures and strategies aimed at minimizing tax liabilities. The TCJA introduced several such measures, but with its sunset, taxpayers may need to revisit their strategies to maintain tax-efficient financial planning. Here are some key examples of tax efficiencies that are at risk of expiring:

Increased Standard Deduction:

The TCJA nearly doubled the standard deduction, reducing the number of taxpayers itemizing their deductions. Once the sunset occurs, the standard deduction will revert to its pre-TCJA level, which may result in higher taxable income for many taxpayers.

Reduced Individual Income Tax Rates:

The lower individual income tax rates introduced by the TCJA will return to their higher, pre-TCJA levels. This change will affect take-home pay and overall tax liabilities.

Expanded Child Tax Credit:

The TCJA increased the child tax credit from $1,000 to $2,000 per qualifying child and modified the phase-out thresholds. With the sunset, the credit amount and income thresholds will revert, reducing many families' benefits.

Pass-Through Business Income Deduction:

The TCJA introduced a 20% deduction for pass-through business income (Qualified Business Income - QBI). This deduction will no longer be available post-2025, impacting small business owners and self-employed individuals.

Estate and Gift Tax Exemption:

The estate and gift tax exemption was significantly increased under the TCJA. In 2025, it will revert to pre-2018 levels, which may subject more estates to taxation and reduce the amount that can be transferred tax-free during a lifetime or at death.

Itemized Deductions:

Several itemized deductions, including the deduction for state and local taxes (SALT) limited to $10,000 per year, may return to their pre-TCJA status. This could increase the taxable income of higher earners residing in high-tax states.

Changes in Complex Tax Laws

The expiration of TCJA provisions will result in a reversion to the pre-2017 tax code, which includes more complex and, in many cases, less favorable tax laws. This impending shift makes it imperative for taxpayers to seek guidance from tax planning services and optimize business taxes well before 2025.

Impact on Individuals and Families

How the 2025 Tax Sunset Affects Individuals

The 2025 tax sunset will significantly impact individuals by altering several key aspects of the tax code. With the expiration of the Tax Cuts and Jobs Act (TCJA), many favorable provisions are set to revert to pre-2017 conditions. Understanding these changes is essential for effective income tax planning.

Personal Income Tax Changes

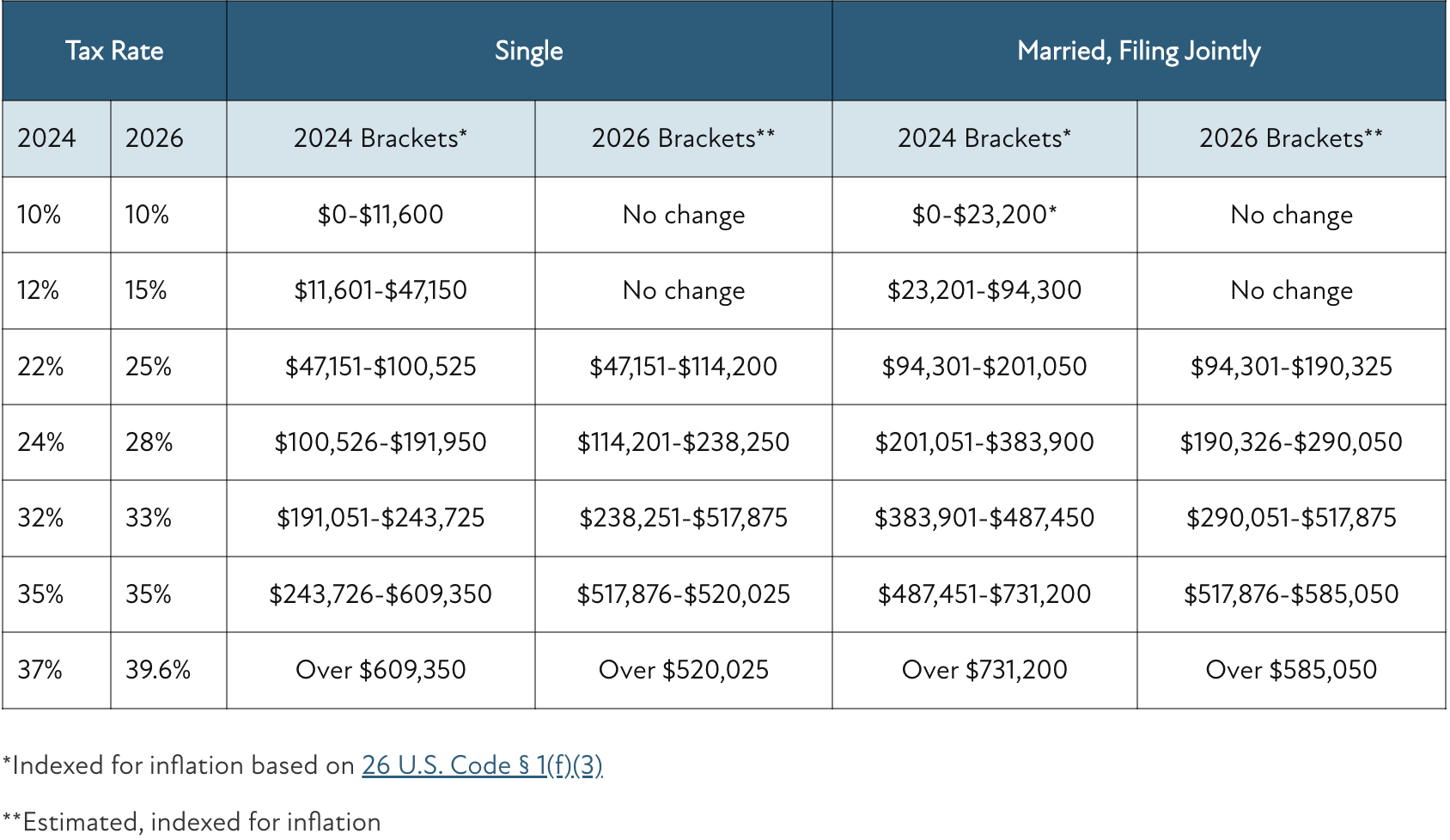

One of the most notable effects of the TCJA sunset will be increased personal income tax rates. The lower rates established by the TCJA will revert to higher pre-2017 levels, leading to increased tax liabilities for many taxpayers. Additionally, the brackets themselves will shift, potentially pushing individuals into higher tax brackets and resulting in higher effective tax rates.

Adjustments to Deductions and Exemptions

The expiration of the TCJA will also bring changes to deductions and exemptions, profoundly affecting individual taxpayers and highlighting the importance of income tax planning. The standard deduction, which was nearly doubled under the TCJA, will decrease, thereby reducing the amount of income that can be offset.

Furthermore, personal exemptions, eliminated under the TCJA, may be reintroduced, complicating tax filings and potentially increasing taxable income for many households.

Implications for Families

Beyond individual taxpayers, families will also face significant changes due to the 2025 tax sunset. These changes include adjustments to estate and gift taxes and revisions to the child tax credit, which can impact financial planning for families at various income levels.

Estate and Gift Tax Adjustments

Under the TCJA, the estate and gift tax exemption amount was significantly increased, allowing individuals to transfer larger amounts of wealth without incurring taxes. However, come 2025, this exemption will revert to pre-2017 levels, decreasing from nearly $14 million per person to around $7 million. With the federal gift and estate tax rate at 40%, this reduction can lead to substantial additional taxes for many estates.

To mitigate these impacts, families must engage in thorough tax planning. Utilizing the higher exemption limits by making significant gifts before the end of 2025 is crucial. Individuals can gift appreciating assets to an irrevocable trust, shielding future appreciation from taxes. Additionally, strategies like the spousal lifetime access trust (SLAT) offer flexibility and control while removing assets from the taxable estate.

Consulting with an estate planning attorney to develop a comprehensive plan is advised. Proper planning allows families to take full advantage of the higher exemption, reducing their taxable estates and preserving wealth for future generations. By preparing now, families can effectively transfer their wealth, minimize tax burdens, and support philanthropic goals.

Child Tax Credit Modifications

The enhanced child tax credit introduced by the TCJA is set to decrease, affecting the amount of credit available per qualifying child. This change will result in lower tax savings for families and necessitate adjustments to tax planning strategies to optimize benefits.

Importance of Tax Planning Services

Given the complexities and potential financial implications of the TCJA sunset, the importance of tax planning services cannot be overstated. Utilizing the expertise of a tax planning advisor, such as Cornerstone’s tax expert, Cindy Meares, is crucial to navigate these changes efficiently.

Utilizing Tax Planning Advisors

Tax planning advisors can provide strategic guidance and tailored solutions to address the evolving tax landscape. They offer insights on optimizing deductions, managing estate plans, and effectively utilizing available credits, ensuring that individuals and families remain compliant and minimize tax liabilities.

Impact on Small Businesses

What Changes for Small Businesses?

The 2025 tax sunset will significantly change the tax landscape for small businesses. The expiration of key provisions under the Tax Cuts and Jobs Act (TCJA) means that business owners must prepare for new challenges in managing their tax liabilities and optimizing their financial strategies.

Expiration of Business Tax Breaks

One of the critical changes small businesses will face is the expiration of specific business tax breaks. The TCJA introduced a 20% deduction for qualified business income from pass-through entities like LLCs, partnerships, and S-corporations.

This deduction provided significant tax relief to small businesses, effectively lowering their taxable income. However, with the TCJA sunset set for December 31, 2025, this benefit will expire, likely leading to increased tax burdens for many small business owners.

To illustrate, over 90% of businesses in the United States are structured as pass-through entities, and eliminating the QBI deduction may significantly increase their tax liabilities. Businesses could see their tax rates rise by an additional 9%, which may compel them to explore alternative strategies to maintain tax efficiencies. Strategies such as accelerating income, deferring deductions, and leveraging other remaining tax benefits may mitigate the impact of these changes.

Business decision-makers must stay engaged and informed about potential legislative changes for comprehensive planning. This proactive approach will enable them to adapt and achieve tax efficiency amidst evolving tax laws.

Reversion of Deduction Limits

The TCJA also increased the limits for various deductions, such as the deduction for interest expenses, bonus depreciation, and the first-year expensing of depreciable assets (Section 179 deduction). With the sunset, these limits will revert to their lower pre-TCJA levels, potentially increasing taxable income and reducing cash flow for small businesses. Business owners must plan accordingly to mitigate these impacts and explore opportunities for effective business tax management.

Strategies to Optimize Business Taxes

Proactively optimizing business taxes will be essential for small businesses navigating the post-2025 tax landscape. Early planning and strategic tax management can help businesses minimize tax liabilities and adapt to the changes brought about by the TCJA sunset.

Advantages of Early Tax Planning

Early tax planning allows businesses to anticipate changes and implement strategies to optimize their tax positions. This includes evaluating the timing of income and expenses, maximizing available deductions and credits, and exploring tax-saving opportunities such as retirement plan contributions and tax-efficient investment options. Proactive planning helps businesses stay ahead of tax changes and ensures financial stability.

Business Tax Management Tips

Effective business tax management requires a comprehensive approach considering various aspects of the business's financial operations. Key tips for managing business taxes include:

Reviewing and adjusting the business structure to optimize tax benefits.

Keeping detailed and accurate financial records to support deductions and credits.

Exploring opportunities for tax deferral, bonus depreciation, and acceleration to manage cash flow.

Utilizing credits and incentives available at the federal, state, and local levels.

Staying informed about tax law changes and new legislation from Congress while seeking professional guidance to navigate complex tax laws.

Importance of Professional Guidance

Given the complexities and potential financial implications of the TCJA sunset, working with a tax planning advisor for business is crucial. Professional guidance can help businesses navigate the evolving tax landscape and implement effective tax strategies.

Working with a Tax Planning Advisor for Business

A tax planning advisor for businesses can provide personalized advice and tailored solutions to address the unique needs of small businesses. Cornerstone’s tax experts offer insights on optimizing business taxes, managing deductions and credits, and ensuring compliance with tax laws. Working with a tax planning advisor allows small businesses to stay prepared for the 2025 tax sunset and maintain financial health.

Preparing for the Future

As we approach the 2025 tax sunset, individuals, families, and small businesses must begin planning now. Understanding the impending changes and their potential impacts is the first step toward effective tax management and financial stability.

Early Planning

Early tax planning, including considering the lifetime exemption, is essential for navigating the complex tax laws that will come into effect post-2025. By engaging in proactive tax efficiencies and optimizing business tax strategies now, taxpayers can mitigate the financial impacts and take advantage of available opportunities. It is especially important to review current tax positions, identify areas for improvement, and implement adjustments well before the expiration of the Tax Cuts and Jobs Act (TCJA) provisions.

Engaging with Experts

Given the complexities involved, seeking professional guidance from tax planning advisors is highly recommended. The experts at CWG can provide invaluable insights and tailored solutions to address individuals, families, and businesses' unique needs.

By working with a tax planning advisor, you can navigate the upcoming changes confidently and effectively, ensuring you are well-prepared for the 2025 tax sunset.

As the TCJA provisions are set to expire, it's important to stay informed, make necessary adjustments, and seek professional advice. Doing so can optimize your tax position, manage your financial health, and ensure compliance with evolving tax laws.

This is for informational purposes only and does not serve as personal tax advice. Please speak to a qualified tax representative regarding your unique circumstances. Links within this blog are not associated to Cornerstone Wealth and are subject to change. Hyperlinks will take you to a third-party website whose content Cornerstone Wealth does not control. Investment advisory services offered through Cornerstone Wealth Group, LLC dba Cornerstone Wealth, an SEC registered investment adviser.